So, what's a good annual churn rate for a SaaS company? The short answer is somewhere between 5% and 7%. But that number is almost meaningless without context.

Think of it this way: the churn rate you should aim for depends entirely on who you're selling to. A company serving small businesses will have a totally different "good" number than one catering to massive enterprise clients. Your customer base is like a bucket of water, and churn is the leak. These benchmarks help you figure out if you've got a slow drip or a gaping hole.

Why SaaS Churn Rate Benchmarks Matter

Asking for a "good" churn rate without context is like asking for a good race time without knowing if you're running a sprint or a marathon. The number that signals success for a startup selling to other startups is worlds away from what an established enterprise software giant tracks.

This is why SaaS churn rate benchmarks aren't a single, magic number. They're a spectrum.

These benchmarks give you a crucial frame of reference. They help you understand whether your customer attrition is normal for your corner of the market or a red flag pointing to deeper problems with your product, pricing, or customer support. Without them, you're just flying blind.

Finding Your Place in the Industry

So, where do most SaaS companies actually land? Across the board, a typical annual churn rate hovers between 10% to 14%. Getting below 5% is widely considered the gold standard, but it's tough to achieve.

In fact, reports show that 60% to 70% of SaaS companies don't manage to dip below that 5% mark. This just goes to show how much room for improvement there is for almost everyone. You can dig into more SaaS statistics to see just how common this challenge is.

Knowing these averages is the first step. It helps you set realistic goals and measure your performance against companies that look like yours.

A high churn rate is the silent killer of a SaaS business. It eats away at your revenue, inflates customer acquisition costs, and screams to investors that your company has a leaky bucket that can't hold onto value.

Context Is Everything

The single most important factor shaping your target churn rate is who you sell to. Different types of customers have completely different levels of loyalty, budget stability, and operational inertia. To use SaaS churn rate benchmarks correctly, you have to slice them by your ideal customer profile.

Here's a quick breakdown of what you should expect:

- Small and Medium-Sized Businesses (SMBs): These customers are usually more sensitive to price and, frankly, are more likely to go out of business. A higher churn rate isn't just expected here; it's often acceptable.

- Mid-Market Companies: This segment is the middle ground. They're more stable than SMBs but less locked-in than enterprises, which leads to moderate, but manageable, churn rates.

- Enterprise Clients: Large corporations sign long-term contracts, weave your software deep into their operations, and face massive costs if they decide to switch. SaaS companies selling to this segment should be aiming for the lowest churn rates possible.

Before you set any goals, it's helpful to have a clear picture of what "good" looks like for your specific target market.

Quick Guide to Annual SaaS Churn Rate Benchmarks

This table offers a snapshot of annual churn rates, breaking them down by the type of customer you serve. Use it to gauge where you stand.

| Performance Level | Targeting SMBs | Targeting Mid-Market | Targeting Enterprise |

|---|---|---|---|

| Poor | Above 15% | Above 12% | Above 8% |

| Average | 10% – 15% | 8% – 12% | 5% – 8% |

| Excellent | Below 10% | Below 8% | Below 5% |

Looking at these numbers, it’s clear that a 5% churn rate for an enterprise-focused company is just average, while the same rate for an SMB-focused one would be outstanding.

Understanding this context is what lets you move from a vague, industry-wide average to a specific, actionable benchmark that actually reflects your business. This is the foundation of any solid retention strategy.

How to Measure Customer and Revenue Churn

Before you can even think about comparing your numbers against SaaS churn rate benchmarks, you have to know what you're actually measuring. Just counting lost customers only gives you half the picture. The two metrics that really matter are customer churn and revenue churn, and they each tell a very different story about the health of your business.

Think of it like running a gym. Let's say you start the month with 100 members and end with 95. Simple enough, right? You lost 5 members.

But what if those 5 people were on your most expensive premium plan, while the new members you gained all signed up for a cheap, basic option? Your total member count looks pretty stable, but your revenue just took a serious dive.

This is exactly why the best SaaS companies track both the "who" and the "how much."

Calculating Customer Churn Rate

Customer churn, sometimes called logo churn, is the most direct way to measure how many customers you're losing. It answers one simple question: What percentage of our customers bailed on us over a specific period?

The formula is about as straightforward as it gets.

- Take the number of customers you had at the start of the period (like the first of the month).

- Count up how many customers canceled during that same period.

- Divide the number of churned customers by your starting customer count.

- Multiply by 100 to turn it into a percentage.

For example: Let's say you started January with 200 customers. By the end of the month, 10 of them have canceled their subscriptions.

(10 Churned Customers / 200 Starting Customers) * 100 = 5% Customer Churn Rate

This number is your go-to for understanding the general stickiness of your product. A high customer churn rate can signal problems with everything from your onboarding process and product-market fit to your customer support. It tells you that customers, regardless of how much they pay, are walking away.

Calculating Revenue Churn Rate

While customer churn is about counting heads, revenue churn is all about counting the dollars. This metric shows you the real financial damage caused by departing customers, which is often a much more telling sign of trouble than the customer count alone. It tracks the monthly recurring revenue (MRR) you lose from both cancellations and downgrades.

The basic formula, known as Gross Revenue Churn, works a lot like the customer churn formula.

- Formula: (MRR Lost from Churned/Downgraded Customers in Period / MRR at Start of Period) * 100

But the real magic is in the Net Revenue Churn calculation. This gives you the full story by also factoring in expansion revenue—the extra cash you made from existing customers who upgraded their plans or bought add-ons.

Net Revenue Churn Rate = [(Churned MRR – Expansion MRR) / Starting MRR] * 100

Let's break it down with a quick scenario.

- Starting MRR: $50,000

- MRR lost from cancellations: $4,000

- MRR gained from upgrades: $1,500

First, you figure out the net MRR lost: $4,000 (Churn) – $1,500 (Expansion) = $2,500.

Then, you plug that into the formula: ($2,500 / $50,000) * 100 = 5% Net Revenue Churn.

This distinction is absolutely critical. If the expansion revenue from your happy, loyal customers is greater than the revenue you lose from churned ones, you can hit negative net revenue churn. That's the holy grail for any SaaS business, because it means you're growing your revenue even without signing up a single new customer.

Tracking revenue churn is also a great way to evaluate if you are spending too much on customer acquisition. You can find out more about the relationship between churn and SaaS customer acquisition cost in our detailed guide.

Churn Benchmarks by Company Size and Stage

Not all churn is created equal. The saas churn rate benchmarks for a scrappy startup are worlds apart from those for an established public company. Your company's size, maturity, and annual recurring revenue (ARR) are the biggest factors in figuring out what a realistic and healthy churn rate looks like. A one-size-fits-all number just doesn't work.

Think about a young startup that's still dialing in its product-market fit. It's attracting all sorts of customers, and frankly, some of them are not the right fit. A higher churn rate during this experimental phase isn't just common—it’s often a necessary part of the learning curve. On the flip side, a large, stable enterprise has its ideal customer profile nailed down and a product with deep operational roots, making its customer relationships far stickier.

Early-Stage and Small Companies

For companies just getting started, the rules are different. The main goal is finding product-market fit, which almost always means testing the waters with different customer segments. This exploration inevitably leads to higher churn as you figure out who your product is truly for and, just as importantly, who it isn't.

Annual churn rate benchmarks reflect this. For instance, companies with annual revenues below $10 million often see median churn rates as high as 20%. That figure might sound like a five-alarm fire for a larger business, but it's a typical part of the journey for a smaller one still carving out its place in the market.

A high churn rate in an early-stage company isn't always a sign of failure. It can be a valuable signal that you're refining your target audience and shedding customers who were never the right fit in the first place.

This period is all about survival and adaptation. As the company grows and its product becomes more essential to its core users, that 20% number is expected to drop—a lot. The focus shifts from broad acquisition to targeted retention. This is where understanding your metrics becomes vital. Check out our guide on how to calculate SaaS customer acquisition cost to see how churn directly impacts your growth spending.

Mid-Market and Growth-Stage Companies

As a SaaS company matures and its revenue grows, its churn rate should naturally come down. For businesses in the $3M to $20M ARR range, especially bootstrapped ones, the median gross revenue retention rate is around 92%. That translates to an 8% annual churn rate. These companies have generally found their footing.

They have a more established product, a clearer ideal customer profile, and more sophisticated onboarding and customer success processes. Their customers are more invested, and the switching costs are higher than for SMBs. At this stage, churn is less about finding the right market and more about optimizing the customer experience and proving ongoing value.

Enterprise and Established Companies

For large, established SaaS companies, the churn benchmarks are much, much lower. These businesses often serve enterprise clients who sign multi-year contracts and integrate the software deeply into their day-to-day operations. The cost and complexity of ripping out that software and switching to a competitor are enormous, creating a powerful incentive to stick around.

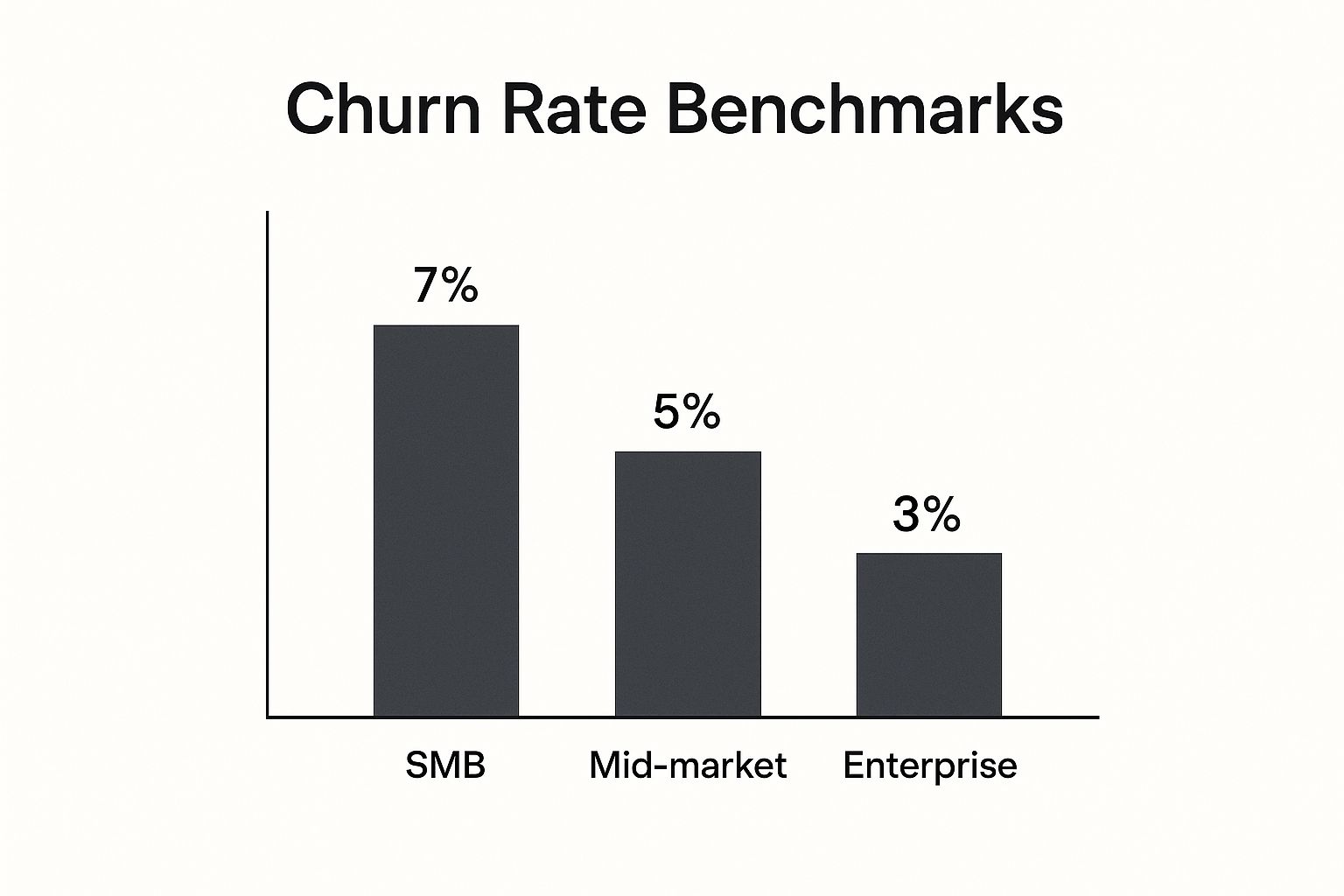

This chart breaks down the typical annual customer churn rates based on the primary customer segment a SaaS company serves.

As you can see, as the customer size increases from SMB to Enterprise, the acceptable churn rate drops significantly. This reflects greater customer stability and those high switching costs we mentioned.

Enterprise-focused SaaS companies often aim for annual churn rates well below 5%. They get there through a few key strategies:

- Long-Term Contracts: Annual or multi-year agreements lock in customers and revenue.

- High Switching Costs: Deep integration with a customer's tech stack makes leaving difficult and expensive.

- Dedicated Customer Success: Proactive support and strategic guidance ensure clients are actually succeeding with the product.

- Expansion Revenue: Upselling and cross-selling to existing accounts can more than make up for the revenue lost from the few customers who do leave.

Ultimately, the right saas churn rate benchmark for your company is a moving target. It depends entirely on your current stage, who you sell to, and your business model. Use these segmented benchmarks as a guide to set realistic goals and measure your progress as you scale.

Understanding Why Customers Really Leave

When a customer leaves, it’s tempting to just file them under "churned" and move on. But that’s a huge mistake. If you dig a little deeper, you’ll find that not all churn is created equal. It really boils down to two distinct types: voluntary and involuntary.

Think of it this way: voluntary churn is a conscious breakup. The customer made a deliberate choice to cancel their subscription. On the other hand, involuntary churn is more like an accidental ghosting—the customer disappears, but they didn't mean to. Nailing this distinction is your secret weapon, because it lets you tackle two very different problems with the right solutions.

The Conscious Decision to Leave

Voluntary churn is what happens when a customer actively decides to end their relationship with you. This is the kind of churn that keeps founders up at night because it's a direct reflection on your product, your value, or your competition.

The reasons for a conscious breakup can be all over the map, but they usually fall into a few common buckets:

- Poor Onboarding: They never really figured out how to get value from your product, got frustrated, and bailed.

- Missing Features: A competitor launched a cool new tool that solves a problem you don't, and your customer jumped ship.

- Bad Customer Experience: They hit a snag, support was slow or unhelpful, and you lost their trust.

- Price Sensitivity: They found a cheaper option that was "good enough" and decided to save a few bucks.

- Evolving Needs: Their business grew or pivoted, and your solution just wasn't the right fit anymore.

Tackling voluntary churn means getting serious about your entire customer journey. You have to build real relationships and consistently prove your worth. If you need a refresher on the fundamentals, our guide to customer relationship management basics is a great place to start.

Voluntary churn is a direct signal from the market. It tells you exactly where your product, pricing, or customer service is falling short. Listening to this feedback is the key to long-term retention.

The Accidental Slip Up

While voluntary churn is a big strategic puzzle, involuntary churn is often just a technical glitch. It's the lowest-hanging fruit for improving your metrics because it’s "accidental" churn caused by simple payment failures.

This kind of churn happens for really mundane reasons:

- A credit card expires.

- The card on file gets lost or stolen.

- A bank flags a transaction for fraud prevention.

- The card hits its credit limit.

The customer doesn't actually want to leave. In fact, most of the time, they have no idea there's a problem until they get locked out of their account. This is completely preventable churn, and it’s responsible for a surprising amount of lost revenue.

The average monthly churn rate for B2B SaaS companies hovers around 3.5%. Of that, voluntary churn makes up about 2.6%, while involuntary churn from things like payment failures adds up to roughly 0.8%. Going after that 0.8% is often the quickest way to boost your revenue without touching your product.

Fixing involuntary churn is all about setting up an automated dunning management system. It's a fancy term for a simple process: proactively notifying customers about payment issues and making it dead simple for them to update their info.

By separating these two types of churn, you can create a two-pronged attack: one strategy focused on delighting customers, and another focused on fixing technical hiccups. This approach ensures you’re not leaving easy money on the table.

Proven Strategies to Reduce SaaS Churn

Okay, so you’ve got your numbers. Understanding your SaaS churn rate benchmarks is the diagnostic step—now it's time for the treatment. Just knowing your churn rate isn’t enough. Real growth comes from turning those insights into a concrete action plan to keep more customers around for longer.

This isn’t about some massive, company-wide overhaul. Sustainable churn reduction comes from a series of targeted, tactical improvements across the entire customer journey. From the first moment a user signs up to the day their credit card expires, every single interaction is a chance to build loyalty or create friction.

Think of these strategies as your playbook for plugging the leaks in your customer bucket, one by one.

Perfect Your Onboarding Process

A customer’s first few days are make-or-break. A confusing or frustrating onboarding experience is one of the fastest tickets to churn city. Your one and only goal here is to guide users to their first "aha!" moment as quickly and smoothly as possible.

It's like being a tour guide in a new city. You wouldn't just drop someone in the middle of a busy square and walk away. You’d point out the key landmarks and help them get their bearings so they feel confident enough to explore on their own.

To make your onboarding actually work:

- Create a Welcome Series: Use a sequence of emails or in-app messages to highlight core features and offer genuinely helpful tips.

- Use Interactive Walkthroughs: Don't just tell them, show them. Guide new users through essential tasks with step-by-step tutorials right inside your app.

- Set Up an Onboarding Checklist: Give people a clear path to follow. Show them exactly what they need to do to get set up and start winning.

A seamless setup makes users feel successful right away, which dramatically increases the odds they'll stick around. This is a foundational step in improving customer lifetime value and shutting down that dreaded early-stage churn.

Be Proactive with Customer Success

Stop waiting for customers to tell you they're unhappy. By the time they send a frustrated support ticket, you might have already lost them. The best retention strategy is proactive—identifying at-risk customers before they even think about canceling.

This is exactly what a customer health score is for. It's a metric you create by combining different signals—like product usage, login frequency, and support ticket history—to get a constant pulse on each customer's engagement level.

A low health score is your early warning flare. It’s a signal to reach out, offer help, re-engage them with some training, or figure out what’s holding them back.

A dedicated customer success team can use these scores to focus their energy where it matters most. Instead of treating every customer the same, they can zero in on those who need a hand, turning a potential churn risk into a loyal fan. This proactive approach is what separates companies with average churn from those with world-class retention.

Systematically Collect and Act on Feedback

Your churning customers are basically giving you a free, brutally honest consultation on how to make your business better. So, are you listening? Setting up a system to collect feedback is good, but the real magic happens when you actually act on what you learn.

When a customer cancels, don’t just let them drift away. Use an exit survey to ask one simple question: "What was the main reason you decided to cancel?" The answers are a goldmine—a direct roadmap for your product and service improvements.

Here’s a simple process to get started:

- Automate Exit Surveys: Trigger a short survey the moment a customer cancels.

- Categorize the Feedback: Group the responses into themes like "Missing Features," "Too Expensive," or "Bad User Experience."

- Share Insights with Your Team: Get this feedback in front of your product and marketing teams regularly to help them set priorities.

Acting on this feedback closes the loop. It shows both current and future customers that you’re committed to improving, which builds trust and makes your product stronger over time.

Automate the Fight Against Involuntary Churn

Finally, let's talk about the low-hanging fruit. A huge chunk of churn isn't a conscious choice—it's just an accident. Involuntary churn happens when a customer's payment fails because of an expired credit card, insufficient funds, or some random bank issue.

This is 100% preventable with a dunning management system. Dunning is just the automated process of talking to customers about billing failures. A good system will:

- Send pre-dunning emails before a card expires.

- Notify customers the instant a payment fails.

- Provide a simple, secure link to update their payment info.

Fixing involuntary churn is one of the fastest and easiest ways to boost revenue. It’s shocking how much lost income companies can recover just by putting these automated reminders in place. It's a technical solution to a technical problem, and it’s non-negotiable for any SaaS business that's serious about growth.

How Elite Companies Achieve Negative Churn

Hitting a low churn rate is a solid goal, but the real holy grail for any SaaS business is negative churn. Picture this: you're actually growing your revenue every single month, even if you lose a customer or two along the way. That’s not a pipe dream; it’s the powerful reality of negative churn.

This magic happens when the new revenue from your existing customers—through upgrades, add-ons, or new user seats—is greater than the revenue you lose from customers who cancel. It completely flips your growth model on its head, turning your happy customer base into its own powerful engine for expansion.

The key metric to watch here is Net Revenue Retention (NRR). If your NRR ticks over 100%, you've officially done it. For example, an NRR of 104% means that for every $100 in revenue you had at the start of the year, you now have $104, even after accounting for cancellations.

The Core Strategies for Negative Churn

The best companies don't stumble into negative churn by accident. They build their entire business model around customer growth and value expansion. For them, retention isn't just a defensive play—it's their primary offensive strategy for sustainable growth. This whole approach rests on two core pillars.

First, they design their pricing to grow right alongside their customers. This is often called value-based pricing. Instead of one flat fee, the price is tied to a metric that reflects the value a customer gets, like the number of users, contacts stored, or features used. As the customer’s business grows and they use your product more, their subscription naturally expands with them.

Second, they invest heavily in customer success. And I don't just mean a support team that reacts to problems. I’m talking about a proactive team of advisors dedicated to making sure customers are crushing their goals with the product.

Negative churn is the ultimate proof of product-market fit and customer value. It signals that your product is so integral to your customers' success that they are willing to invest more in it over time.

Putting It Into Practice

Getting to negative churn requires a company-wide commitment to delivering ongoing value. It's a mindset, not just a metric. The most successful companies zero in on a few key initiatives to make it happen:

- Mastering Upselling and Cross-selling: They don’t sit around waiting for customers to ask for more. Their customer success teams are trained to spot opportunities to introduce premium features or complementary products that solve the next problem a customer will have.

- Creating a Tiered Pricing Structure: They build clear and logical upgrade paths. As a customer’s needs get more sophisticated, there's always a next step to a higher-tier plan that offers more power and functionality. It feels like a natural progression, not a sales pitch.

- Driving Deep Product Adoption: They are obsessed with getting customers to use more of the product. The more features a customer uses, the "stickier" the product becomes, and the more likely they are to see enough value to upgrade.

Ultimately, negative churn is what happens when a business is perfectly aligned with its customers' growth. It transforms the internal conversation from "how do we stop customers from leaving?" to "how can we help our customers succeed even more?"

Frequently Asked Questions About SaaS Churn

Even after getting the hang of SaaS churn rate benchmarks, a few common questions always seem to pop up. Here are some straightforward answers to help you put these ideas into practice.

What Is a Good Monthly Churn Rate for a B2B SaaS Company?

For most B2B SaaS companies, a good monthly churn rate is anything below 1%. That works out to an annual churn rate of less than 12%. But this isn't a one-size-fits-all number; it really depends on who you're selling to.

- For SMBs: A monthly rate of 3-5% is often considered acceptable. Smaller businesses can be more volatile, so a little more churn is expected.

- For Enterprise Clients: The bar is set much higher. You should be aiming for well under 1% monthly. Big contracts and high switching costs mean these customers are much stickier.

How Often Should I Measure and Report on Churn?

You should keep an eye on churn constantly, but the formal reporting cadence is usually monthly and quarterly.

Think of it this way: monthly tracking is for your internal team. It helps you spot problems right away, like a sudden jump in cancellations after a feature change, and fix them fast. Quarterly reporting is more for the big picture—sharing trends with your leadership team or investors. It smooths out the monthly bumps and shows the true health of the business over time.

Chasing zero churn is a rookie mistake. A far better goal is hitting negative net revenue churn. That’s the sweet spot where the revenue you gain from existing customers upgrading or expanding is greater than the revenue you lose from customers who leave.

Can Churn Rate Ever Be Zero?

It's a nice thought, but getting to a 0% churn rate is pretty much impossible for any SaaS business in the long run. Some customers will always leave for reasons you can’t control. They might go out of business, get acquired, or pivot their entire strategy. It happens.

Instead of getting obsessed with an unrealistic number, pour that energy into keeping your churn rate as low as possible while finding ways to grow revenue from the customers who stick around.