So, what exactly is SaaS Customer Acquisition Cost (CAC)? Put simply, it’s the total amount you spend on sales and marketing to land a single new customer. Think of it as the price tag for bringing someone new into your world, covering everything from ad spend and content creation to your team's salaries.

It's one of the most important numbers in your business. CAC tells you if your growth is actually profitable or if you're just burning cash to look bigger.

Why Customer Acquisition Cost Is So Important

Imagine trying to build a house without knowing what bricks, wood, or labor cost. You’d run out of money before the foundation was even dry. The same logic applies to growing a SaaS company—without a firm grip on your CAC, you’re building blind. It’s the foundational metric that shows whether your business model can actually sustain itself.

Knowing your CAC helps you make smarter, data-driven decisions across the board. It’s what separates wild guessing from a calculated, responsible approach to scaling your business.

The Rising Challenge of Acquiring Customers

Let’s be honest: winning new customers is getting harder and more expensive every year. Between 2013 and 2025, the average customer acquisition cost has shot up by a staggering 222%. Back in 2013, the average loss per new customer was about $9, but that number has ballooned to $29.

This trend is driven by skyrocketing ad costs and fierce competition for your audience's attention. That's why being efficient with your acquisition spending is more critical now than ever before. You can dig into these acquisition cost statistics to get the full picture of this trend.

What CAC Reveals About Your Business

Calculating your CAC is far more than just an accounting chore. It's a health check for your entire go-to-market strategy, acting as a direct report card on your sales and marketing efforts.

A clear understanding of this single metric helps you:

- Evaluate Marketing Channel Performance: Pinpoint which channels (like SEO, paid ads, or social media) are actually bringing in customers cost-effectively.

- Optimize Your Pricing Strategy: Make sure your subscription prices are high enough to cover acquisition costs and still leave a healthy profit margin.

- Forecast Budgets Accurately: Make informed decisions about how much you can afford to spend to hit growth targets without going broke.

- Assess Business Model Viability: Ultimately, CAC helps you answer the most important question: Is my business built to last?

A high SaaS customer acquisition cost isn’t automatically a red flag, but an unprofitable one is. The goal is to spend efficiently, making sure every dollar you put into sales and marketing brings back more in return.

Without knowing this number, SaaS companies often make a fatal mistake: spending more to acquire a customer than that customer will ever be worth. That’s a fast track to serious cash flow problems and a growth model that's destined to collapse. By mastering your CAC, you give yourself the insight needed to build a resilient and truly profitable company.

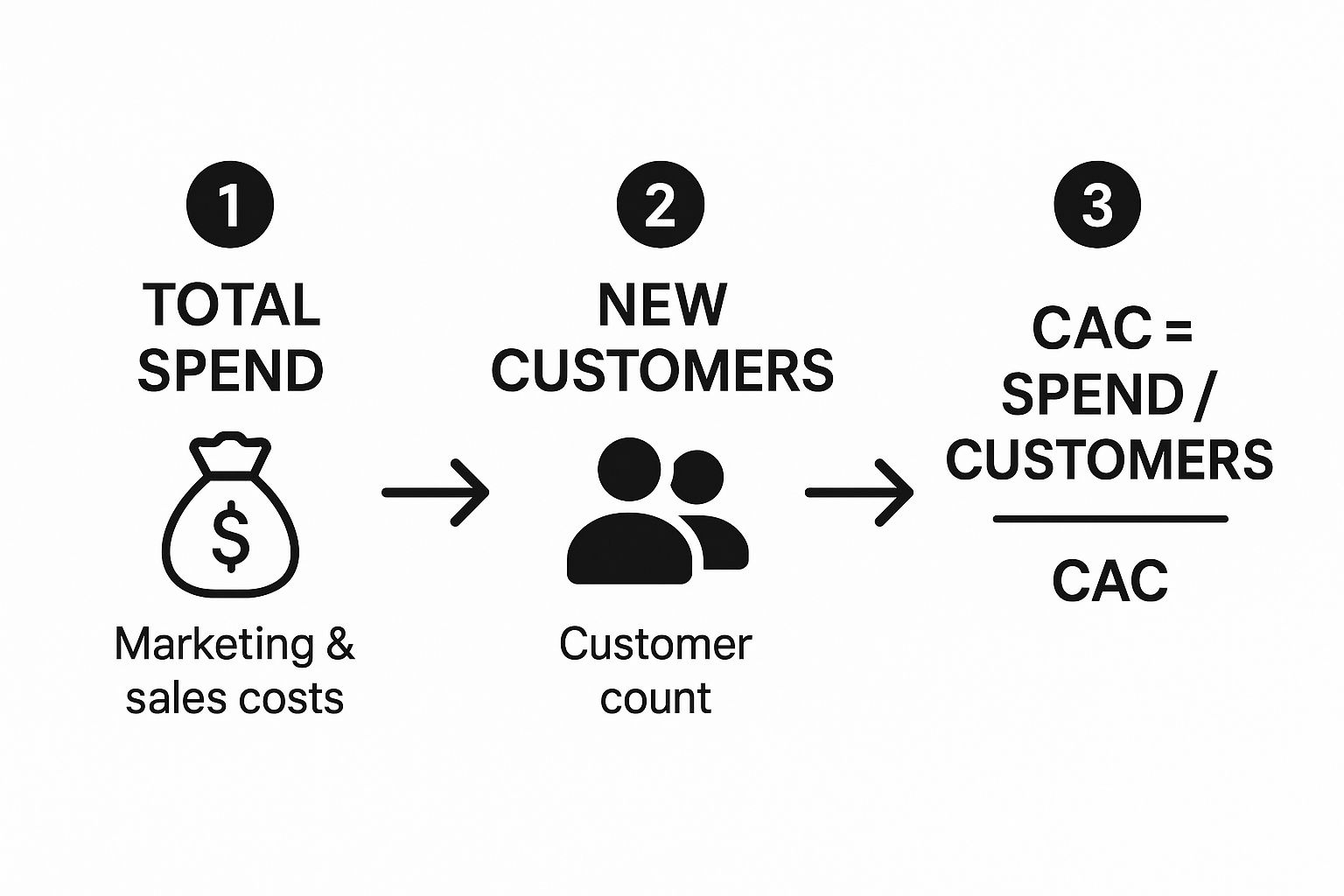

How to Accurately Calculate Your SaaS CAC

Figuring out your SaaS customer acquisition cost (CAC) seems simple on the surface, but a truly accurate number requires more than just a quick back-of-the-napkin calculation. While the basic equation is easy enough to grasp, the real magic—and precision—comes from knowing exactly what costs to toss into the mix.

At its core, the formula is: Total Sales & Marketing Costs / Number of New Customers Acquired = CAC.

It’s a straightforward process when you break it down: you combine all your spending with the number of new customers you brought in to find your final cost per customer.

As you can see, the math itself is just simple division. But the accuracy of that final number lives and dies by how well you track both sides of the equation—your costs (the numerator) and your new customer count (the denominator).

Identifying All Your Acquisition Costs

To get a true picture of your CAC, you need to account for every single dollar you spent to win new customers over a specific period, whether it's a month or a quarter. This goes way beyond just your ad spend.

Think of it this way: what did it really cost to get those new logos? The answer lies in a complete audit of your sales and marketing expenses. Overlooking even one category can give you a misleadingly low CAC, which can lead to some seriously flawed strategic decisions down the road.

To nail down an accurate CAC, you absolutely must include the following expenses. These are the non-negotiables.

| Essential Expenses for a Precise CAC Calculation | ||

|---|---|---|

| Expense Category | Specific Examples | Why It's Included |

| Salaries and Commissions | Base salaries for the entire sales and marketing teams, sales commissions, performance bonuses. | These are the people driving your acquisition engine. Their compensation is a direct cost of acquiring customers. |

| Software and Tools | CRM subscriptions (e.g., Salesforce), marketing automation platforms (e.g., HubSpot), SEO tools, analytics software. | These tools are the machinery of your acquisition efforts. Without them, your teams can't function effectively. |

| Advertising Spend | Money spent on Google Ads, LinkedIn campaigns, social media advertising, sponsored content, affiliate payouts. | This is the most direct cost. It's the money you pay to put your message in front of potential customers. |

| Content and Creative Costs | Payments to freelance writers, graphic designers, video production agencies, or internal content team overhead. | Great content fuels acquisition. The cost to create blog posts, case studies, and ad creative is a key part of the equation. |

Tallying up these figures is the first and most critical step. Get this part right, and you’re well on your way to a CAC number you can actually trust.

A Practical Calculation Example

Let's make this real with an example. Imagine a SaaS company called "ConnectSphere" wants to calculate its CAC for the last quarter (Q3).

First, the team pulls together all of their sales and marketing expenses for that three-month period:

- Salaries & Commissions: $75,000

- Ad Spend: $30,000

- Tool Subscriptions: $5,000

- Content Creation: $10,000

That brings their total acquisition spend to a neat $120,000. During that same quarter, the ConnectSphere team successfully signed up 400 new customers.

Now, they just need to plug those numbers into the formula:

$120,000 (Total Costs) / 400 (New Customers) = $300 (CAC)

This tells them that ConnectSphere spent an average of $300 to acquire each new customer in Q3. For teams that want to skip the spreadsheet gymnastics, a dedicated customer acquisition cost calculator can automate and simplify this whole process.

Blended CAC vs. Paid CAC

Finally, it’s really important to understand the difference between two flavors of CAC. The $300 we just calculated for ConnectSphere is a blended CAC. It averages the costs across all acquisition channels—organic search, paid ads, referrals, direct traffic, you name it.

Blended CAC is great for a high-level, birds-eye view of your overall acquisition efficiency. The danger is that it can easily hide poor performance in specific channels.

For deeper, more actionable insights, you should also be calculating your paid CAC. This calculation zooms in exclusively on customers you acquired through paid marketing campaigns.

To figure this out, you’d only include your direct advertising spend in the "costs" part of the formula and divide it by the number of customers directly attributed to those ads. This helps you understand the true ROI of your paid channels and tells you exactly where to put your budget for the best results.

Analyzing both blended and paid CAC gives you a much richer, more complete story of how your acquisition engine is really performing.

Connecting CAC to Customer Lifetime Value

Knowing your SaaS customer acquisition cost is like knowing the price of a single puzzle piece. It's useful, sure, but it doesn't show you the full picture. To really understand what that piece is worth, you have to connect it to a much more powerful metric: Customer Lifetime Value (LTV).

LTV is the total revenue you can expect from a single customer over their entire relationship with you. Think of it as the total return you get from that initial investment. If CAC is the cost to get a customer in the door, LTV is the total value they bring once they're inside.

Putting these two metrics side-by-side tells you everything about the health and sustainability of your business. It answers the single most important question any SaaS company can ask: are we spending our money profitably?

The LTV to CAC Ratio Explained

The dynamic between these two numbers is best understood as the LTV to CAC ratio. This simple ratio is probably the most powerful health indicator for your entire business. It shows you exactly how many dollars you get back for every single dollar you spend acquiring a customer.

Calculating it couldn't be simpler: LTV / CAC = Your Ratio.

Let's say your average customer LTV is $900, and your CAC is $300. Your ratio is $900 / $300, which comes out to 3:1. For every dollar you put into sales and marketing, you're getting three dollars back over that customer's lifetime. Not bad at all.

What Your Ratio Reveals About Your Business

The LTV to CAC ratio isn't just a number—it’s a story about your company's efficiency and future potential. Different ratios send completely different signals about the state of your business.

Here’s a simple way to read the signals:

- 1:1 Ratio (The Danger Zone): You’re spending exactly as much to land a customer as they will ever pay you. This means you're breaking even before you even factor in operational costs like R&D and support. This is a fast track to failure.

- 3:1 Ratio (The Ideal Target): This is widely seen as the gold standard for a healthy, growing SaaS business. It means you have a profitable acquisition engine with plenty of margin to cover other costs and reinvest in growth.

- 5:1 Ratio or Higher (Growth Opportunity): This looks great on paper, but a ratio this high might mean you're being too conservative. You could probably grow much faster by strategically increasing your acquisition spend to grab more market share.

The goal isn't just to have a low CAC; it's to maintain a healthy and balanced LTV to CAC ratio. A high CAC can be perfectly acceptable if it's backed by an even higher LTV.

At the end of the day, this ratio gives you the framework to make smart decisions. It tells you when to hit the gas on your marketing spend and when to pump the brakes and dial in your efficiency.

A powerful way to strengthen this ratio is by consistently working to increase how much each customer is worth. For more insights, you can explore strategies for improving customer lifetime value in our related guides.

By tracking CAC and LTV together, you move from just counting costs to strategically managing growth. That shift in perspective is what separates the SaaS companies that just survive from the ones that truly thrive.

Understanding SaaS CAC Benchmarks by Industry

Figuring out your own SaaS customer acquisition cost is a great start, but the real question is: Is that number good, bad, or just… average? This is where industry benchmarks come in. They give you the context you need to make sense of your own data. It’s like knowing your car gets 30 miles per gallon—that number only means something when you can compare it to similar models.

Chasing a single, universal "good" CAC is a recipe for frustration. Costs swing wildly from one sector to another. A fintech platform will almost always have a higher acquisition cost than a simple project management tool, and that’s perfectly okay.

The trick is to understand why these differences exist. Once you do, you can set realistic targets and build a growth strategy that actually works for your business.

Why Do CAC Benchmarks Vary So Much?

Several core factors are behind the huge range of acquisition costs you see across the SaaS world. These aren't just minor tweaks; they're fundamental market dynamics that dictate how much you have to spend to win over a single customer.

- Market Competition: In a crowded market, everyone is bidding for the same keywords and ad space. That drives prices up. On the other hand, a niche SaaS with few direct competitors will naturally enjoy a lower CAC.

- Sales Cycle Length: Think about the difference between enterprise software with a six-month sales cycle and a self-serve tool someone can buy in minutes. The longer, more complex process costs far more.

- Average Contract Value (ACV): The more revenue a customer is worth, the more you can justify spending to get them. A high ACV lets you stomach a higher CAC while still keeping a healthy LTV to CAC ratio.

- Target Audience: Getting in front of C-suite executives at Fortune 500 companies is a whole different ballgame than marketing to freelancers. The former requires a much more expensive, high-touch sales process.

These factors create a unique cost environment for every industry, which is why comparing your CAC to a company in a totally different space is often pointless. The goal isn't to match another industry's numbers, but to be efficient within your own.

Average SaaS CAC Across Key Verticals

So, what do some of these numbers actually look like? To give you a practical yardstick, the average CAC across the entire SaaS world is around $702. But that figure is a blend of wildly different realities.

For instance, fintech SaaS companies often spend up to $1,450 to acquire a customer, while eCommerce-focused SaaS averages a much lower $274. Meanwhile, the broader B2B SaaS average sits closer to $536. You can dig into more detailed SaaS CAC data to see how these numbers shake out.

A "high" CAC isn't inherently bad if the customer lifetime value justifies it. A fintech company spending $1,450 on a customer worth $15,000 has a far healthier business model than an SMB tool spending $300 on a customer worth $400.

To help you place your own company, here's a quick look at typical acquisition costs across a few different SaaS sectors.

Average SaaS CAC Across Industry Verticals

This table breaks down typical customer acquisition costs in different SaaS verticals, giving you valuable context for where you stand.

| SaaS Vertical | Average CAC | Key Contributing Factors |

|---|---|---|

| Fintech | $1,450+ | High customer trust requirements, complex regulations, long sales cycles, and high LTV. |

| Cybersecurity | $3,400+ | Targets high-level decision-makers, involves complex technical sales, and addresses critical business risks. |

| Adtech | $950+ | Extremely competitive market, requires sophisticated demos and proof-of-concept trials. |

| Business Services | $780+ | Broad category, but often involves customized solutions and direct sales team involvement. |

| eCommerce SaaS | $270+ | Shorter sales cycles, often self-serve models, lower average contract values. |

These benchmarks are your guideposts. If your CAC is way higher than your industry average, it might be a sign that your marketing channels or sales process need a tune-up. But if you're well below the average, it could be a green light to invest more aggressively in growth.

Proven Strategies to Lower Your Acquisition Costs

Knowing your SaaS customer acquisition cost is one thing, but the real magic happens when you start actively pushing that number down. Lowering your CAC isn't about gutting your marketing budget—it’s about spending smarter and building a more efficient acquisition engine. Get this right, and you’ll unlock higher profits, faster growth, and a much more durable business.

This is where we move from theory to practice. The following are proven, real-world strategies you can use to shrink your acquisition costs without stalling your growth. These aren’t fluffy, generic tips; they’re specific tactics built for the SaaS battlefield.

Optimize Your Sales and Marketing Funnel

Think of your funnel as the path a stranger takes to become a paying customer. Every single point of friction, every confusing step, costs you money. Even tiny improvements in conversion rates at each stage can have a huge domino effect on your final CAC.

Start by mapping out every touchpoint a user has with your brand. Dive into your analytics and find out exactly where people are dropping off. Is it the pricing page? The trial signup form? Once you pinpoint the leaks, you can start plugging them.

Here are a few actionable steps:

- A/B Test Your Landing Pages: Constantly experiment with different headlines, calls-to-action (CTAs), and visuals. You’d be amazed how a simple wording tweak can boost conversions by several points.

- Simplify Your Signup Forms: Every field you add is another reason for a prospect to give up. Ask only for what you absolutely need to get them started.

- Sharpen Your On-Page SEO: Make sure your key pages are optimized for the right keywords, load lightning-fast, and provide a great user experience. This attracts visitors with higher intent who are far more likely to convert.

Build a Content and SEO Engine

Paid ads get you results now, but it's like renting an audience. The second you stop paying, the traffic dries up. Content marketing and SEO, on the other hand, are like buying an asset. You put in the work upfront, and it pays you back with a steady stream of low-cost, organic leads for years.

Great content does more than just attract visitors. It builds trust, positions you as an expert, and draws in people who are actively searching for the exact solution you offer. These leads are usually much warmer and convert at a higher clip than outbound leads, which pulls your blended CAC down over time.

A well-executed content strategy doesn’t just attract leads; it pre-sells them. By the time a prospect from an organic search reaches out, they already understand their problem and see you as a credible solution.

This approach takes patience, but the long-term payoff is massive. For a deeper look, you can explore various B2B lead generation strategies that are built on this very principle.

Launch a Powerful Referral Program

Who’s your best salesperson? It's not someone on your team—it's a happy customer. A smart referral program turns your entire user base into a low-cost, high-powered acquisition channel. The leads that come through are incredibly qualified because they arrive with built-in trust.

It's not just a hunch. A study from Nielsen found that 92% of consumers trust recommendations from friends and family over any other type of advertising. When one of your users recommends your SaaS, they’re putting their own reputation on the line, which slashes the time it takes to close a new deal.

To build a program that actually works:

- Offer a Double-Sided Incentive: Don't just reward the referrer; give the new customer a perk, too. Think discounts, account credits, or a free upgrade.

- Make It Effortless: Give your customers a unique link that’s dead simple to share. If they have to jump through hoops, they won’t bother.

- Promote It Actively: A referral program won't run itself. Tell your users about it through email, in-app messages, and social media.

By turning your customers into advocates, you create a powerful growth loop that’s both cheap and incredibly scalable.

Frequently Asked Questions About SaaS CAC

As you start putting these concepts into practice, a few common questions always seem to pop up. Let's tackle them head-on so you can get back to building a smarter growth strategy.

How Often Should I Calculate My SaaS CAC?

You’ll want to calculate your SaaS CAC on two separate cadences: monthly and quarterly. This dual-track approach gives you the best of both worlds.

Monthly checks are for your tactical, in-the-weeds adjustments. They let you see the immediate ripple effects of a new ad campaign or content push, helping you spot weird trends before they snowball into bigger problems.

Quarterly calculations, on the other hand, smooth out the month-to-month noise and give you a more stable, big-picture view. This is the number you'll lean on for strategic planning, budgeting, and investor updates. Relying only on an annual calculation is just way too slow—you'd be flying blind for months at a time.

What Is a Good CAC Payback Period?

For most SaaS companies, a healthy CAC payback period is under 12 months. The goal is simple: recoup the full cost of acquiring a customer within their first year. If you can hit that mark, you’re in a great spot.

Now, for early-stage, high-growth startups, you can sometimes stretch that to 18 months. This is often acceptable when you're aggressively investing to grab market share before a competitor does.

But be careful. Anything longer than 18 months starts to signal an unsustainable business model. A lengthy payback period puts a massive strain on your cash flow, making it incredibly difficult to fund future growth without another round of capital.

How Do Inbound and Outbound Marketing Affect CAC?

Inbound and outbound marketing impact your SaaS customer acquisition cost in completely different ways. Understanding this distinction is key to building a balanced and effective acquisition machine.

Inbound marketing, which is all about SEO, content, and community building, generally drives a lower CAC in the long run. It's an engine that attracts organic leads who are already looking for a solution like yours. The catch? It requires a hefty upfront investment in time and resources, and it takes patience to see results. But once it gets going, it's a sustainable, cost-effective way to grow.

Outbound marketing, like paid ads and cold outreach, is the opposite. It usually delivers faster results but comes with a much higher and more direct cost for every customer you acquire.

The smartest founders use a mix of both. Outbound tactics can get you immediate traction and revenue, while a solid inbound strategy works in the background to build a profitable, long-term foundation for growth. This combination gives you both speed and sustainability.